Thank you for choosing to support UMass Chan Medical School

Your gift will make a difference in the health and well-being of the people of the commonwealth and beyond. Many giving options are available:

Planned giving

There are ways to make an important gift commitment without letting go of your assets today. A planned gift option might be the right fit for your personal planning. Learn more

Alumni and parent giving

Alumni and parent giving supports needs and programs that help UMass Chan Medical School move medicine forward. Here's how.

How you can make your gift

BY PHONE

Make your credit card donation by calling 508-856-5615 between 8 a.m. to 5 p.m. EST.

Please specify that your gift is to the UMass Chan Medical School Foundation.

ONLINE

Fast and easy using your credit card! After indicating the amount of your gift, follow the prompts to make your gift.

Give here

BY CHECK

Make it payable to "UMass Chan Medical School Foundation" and mail it to:

UMass Chan Medical School Office of Advancement

55 Lake Avenue North, Suite S1-117

Worcester, Massachusetts 01655

What the new tax law means for your giving

7 things you need to know

Changes to the tax code beginning January 1, 2026, could affect how—and when—you choose to give to UMass Chan Medical School and other nonprofits.

What’s new:

- Tax benefit for non-itemizers

Even if you don’t itemize, you can deduct up to $1,000 (single filers) or $2,000 (married couples). So even smaller donations can make an impact. Note: Gifts to donor advised funds are excluded. - New floor for itemizers

You will need to give at least 0.5% of your adjusted gross income (AGI) to claim a charitable deduction. Consider maximizing your giving in 2025 before the new rule takes effect. - New limit for top earners

Currently, top earners get a 37-cent tax benefit for every $1 deducted. Starting in 2026, that drops to 35 cents. If you are in the top tax bracket, consider giving more this year to avoid losing tax benefits next year.

What stays:

- Income tax brackets

The new law permanently extends the current tax rates. - Standard deduction

For 2025, it will be $15,750 for single filers and $31,500 for married couples filing jointly. If you don’t itemize, you may still benefit if you give appreciated stock, real estate or, if you are 70½ or older, from your IRA. - Deduction limit for cash gifts

You can still deduct cash gifts of up to 60% of your AGI. Consider combining your cash and non-cash assets (often called blended giving) to maximize your tax benefits and impact. - Estate and gift tax exemption

It will increase to $15 million per individual and $30 million per married couple filing jointly. Your estate is likely under this amount, so focus on current giving to receive tax benefits.

Want to make the most of a gift to UMass Chan Medical School in 2025? Contact Kim Canty at 508-723-4243 or kim.canty@umassmed.edu. We’d be happy to discuss the best ways you can create a legacy.

Other ways to donate

Tribute giving

Your gift may be made in memory or in honor of someone special. If you are making your gift online, there’s an area on our online giving form to note this; you can also tell us in writing if you submit a check. We’ve written some sample language that can be used for an obituary.

Matching gifts

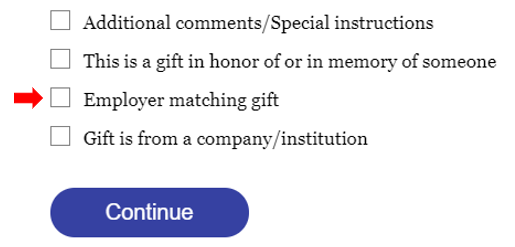

Many employers will match employee charitable contributions, which can double the impact of your gift. If using our online giving form, please check the appropriate box. Contact your Human Resources Department for a matching gift form from your employer and send us a completed copy. We will do the rest.

Planned giving

There are ways to make an important gift commitment without letting go of your assets today. A planned gift option might be the right fit for your personal planning. Learn more.

Payroll deduction - UMass Chan employees

UMass Chan Medical School employees can make charitable donations to the school through payroll deduction. Please contact the Office of Advancement to learn more: 508-856-5524, giving@umassmed.edu.

Donor advised funds

A donor advised fund (DAF), which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to UMass Chan Medical School.

Through your DAF you can recommend a grant to UMass Chan Medical School to support ___________________. The legal name to use is UMass Chan Medical School Foundation, Inc., and the tax ID number is 04-3108190.

Do you have a donor-advised fund (DAF) through Fidelity, Schwab or BNY Mellon? Give directly to UMass Chan via the DAF Direct website.

Securities

Donating appreciated securities or mutual funds is a smart way to support UMass Chan Medical School while potentially reducing capital gains taxes and qualifying for a charitable deduction. Gifts can be made outright or through a transfer on death (TOD) account to extend your impact beyond your lifetime. Learn more.